Step-by-Step Guide on How to Calculate Compound Interest

Compound Interest is not just a mathematical concept; it's a powerful financial tool that plays a vital role in savings and investment growth. Whether you're looking to grow your savings account, maximize your investment returns, or understand the implications of loans and mortgages, understanding how to calculate compound interest is essential.

This comprehensive guide will cover the definition, real-life applications, interest calculation, tools like the compound interest calculator, strategies to maximize compound interest, common mistakes, FAQs, and additional resources.

Definition of Compound Interest

Compound Interest is the interest calculated on the initial principal, which also includes all the accumulated interest from previous periods on a deposit or loan. It's a concept that leads to exponential growth of your money.

Importance of Understanding Compound Interest for Investors

For investors, understanding compound interest is like having a golden key to financial growth. It's a principle that can turn small, regular investments into substantial sums over time.

Simple Interest vs. Compound Interest

● Simple Interest: Calculated on the principal amount, or on that part of the principal amount which remains unpaid. It's linear and doesn't grow over time.

● Compound Interest: Calculated on the initial principal, which also includes all the accumulated interest from previous periods on a deposit or loan. It leads to exponential growth.

How Compound Interest Works

Compound interest works by repeatedly adding earned interest back to the principal amount, leading to exponential growth.

Principal: The original amount.

Interest Rate: The percentage of the principal earned as interest annually.

Compounding Periods: How often interest is added to the principal (daily, monthly, quarterly, etc.).

Time Period: The length of time the money is invested or borrowed for, in years.

Real-Life Applications of Compound Interest

- Savings Account: Banks offer compound interest on savings accounts, making your money grow over time.

- Investment Growth: In investment programs like mutual funds, compound interest can significantly increase returns.

- Loans and Mortgages: Understanding compound interest helps in managing debt, loans, and mortgages.

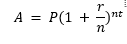

The Mathematical Formula Behind Compound Interest

The general compound interest formula is:

Where:

- A: Accrued Amount (Principal + Interest).

- P: Principal.

- r: Annual Interest Rate.

- n: Number of times interest is compounded in a specific timeframe.

- t: Time frame in years.

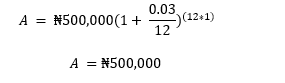

Example Calculations with Step-by-Step Solutions

Let's say you deposit ₦500,000 in a savings account that earns a 3% annual interest rate, compounded monthly. Using the formula, you'd calculate:

So, after a year, you'd have ₦515,207.98 in savings.

Compound Interest Calculators

Online tools for calculating compound interest are widely available. These calculators require inputs like initial investment, monthly contribution, estimated interest rate, and compounding frequency.

How to Calculate Compound Interest Using Various Calculators

- Investopedia Compound Interest Calculator.

- CalculatorSoup Compound Interest Calculator.

- NerdWallet Compound Interest Calculator.

Excel and Spreadsheet Methods

You can also use Microsoft Excel, Google Sheets, or Apple Numbers to create a compound interest calculator. Utilize the FV (Future Value) function to calculate compound interest.

Compound Interest in Savings and Investments

Compound Interest in Savings Accounts

● Annual Percentage Yield (APY): The effective annual rate of return taking into account the effect of compounding interest.

● Certificates of Deposit (CDs): A time deposit offered by banks with fixed interest rates and fixed dates of withdrawal.

Compounding Investment Returns

● Mutual Funds: Compound interest plays a crucial role in mutual fund growth.

● Retirement Accounts: Understanding compound interest is essential for managing retirement accounts like Roth or traditional IRAs.

Risk and Return Considerations

● Short-term Fluctuations: Riskier investments may lose value in the short term.

● Long-term Growth: Over a long time, horizon, a diversified growth portfolio can return an average of 6% annually.

Strategies to Maximize Compound Interest

Starting Early: The Power of Time: The earlier you start saving or investing, the more time your money has to grow. The power of compound interest is most effective over long periods.

Making Regular Contributions: Regular monthly contributions can significantly boost your savings or investment growth. Even small amounts can add up over time.

Choosing the Right Compounding Frequency

Different compounding: frequencies (daily, monthly, quarterly, etc.) can affect your accrued amount. Generally, the more frequent the compounding, the more you earn.

Selecting Suitable Financial Products: Choosing the right savings account, CDs, or investment program aligned with your financial goals is crucial.

Common Mistakes and How to Avoid Them

- Misunderstanding Compounding Periods: Know how often interest is compounded.

- Ignoring the Impact of Additional Contributions: Regular contributions can significantly boost growth.

- Failing to Consider Long-Term Growth Potential: Compound interest works best over long periods.

Frequently Asked Questions (FAQs)

● How to Calculate Compound Interest Without a Calculator?: Use the compound interest formula.

● What Are the Best Places to Invest for Compounding Returns?: Mutual funds, stock market, retirement accounts.

● How Does Daily Compounding Affect My Savings?: Daily compounding can lead to exponential growth.

Recommended Books and Articles on Compound Interest

● "The Compound Effect" by Darren Hardy

● "The Future for Investors" by Jeremy Siegel

Conclusion

Compound interest is a powerful financial concept that can significantly impact your savings and investment growth. By understanding the principles, formulas, and tools like compound interest calculators, you can make informed financial decisions. Whether you're saving for retirement or managing loans and mortgages, compound interest plays a vital role.

Start leveraging the power of compound interest today and unlock the potential of your financial future.

This comprehensive guide covers all aspects of compound interest, from basic definitions to calculations, practical applications, and strategies for maximizing growth. It's designed to be informative and engaging for anyone interested in understanding this essential financial concept. Whether you're a beginner investor or an experienced financial analyst, this guide offers valuable insights and tools to help you succeed in your financial journey.

Visit nairaCompare.ng for more information about loans and savings opportunities.

About Author